Presented by the Lone Star College System – Small Business Development Center

When the recession hit the US economy in 2008, the financial impact on individuals and small business owners was unprecedented. Credit turned into a major road block overnight. This program was designed to bridge the gap of knowledge that left so many stranded.

When the recession hit the US economy in 2008, the financial impact on individuals and small business owners was unprecedented. Credit turned into a major road block overnight. This program was designed to bridge the gap of knowledge that left so many stranded.

At this workshop you will learn:

• What FICO scores mean and how they are used

• The impact of personal credit on small business lending

• What creditors are actually looking for

• Steps you can take to maintain and improve your credit

Space is limited. The first 25 attendees to sign up also will have a chance to talk to a certified credit counselor about their individual situation. Note: Participants who would like one-on-one credit counseling must bring their own credit report. You may obtain your credit report once a year for free at www.annualcreditreport.com

Rebecca Schultz has dedicated the past two decades to helping individuals and small businesses understand the importance of credit, and how it affects your ability to gain access to capital. Mrs. Schultz has been a lender for twenty years, managing both consumer and small business loan programs for Houston financial institutions. She is a certified credit counselor through NIFCE, a certified commercial credit analyst with CUNA, and she holds a bachelor’s degree in Business Administration. As a former business owner herself, she understands first-hand the challenges small business owners deal with on a daily basis. Her knowledge and experience is blended together with humor in a presentation guaranteed to change your perspective on credit.

Rebecca Schultz has dedicated the past two decades to helping individuals and small businesses understand the importance of credit, and how it affects your ability to gain access to capital. Mrs. Schultz has been a lender for twenty years, managing both consumer and small business loan programs for Houston financial institutions. She is a certified credit counselor through NIFCE, a certified commercial credit analyst with CUNA, and she holds a bachelor’s degree in Business Administration. As a former business owner herself, she understands first-hand the challenges small business owners deal with on a daily basis. Her knowledge and experience is blended together with humor in a presentation guaranteed to change your perspective on credit.

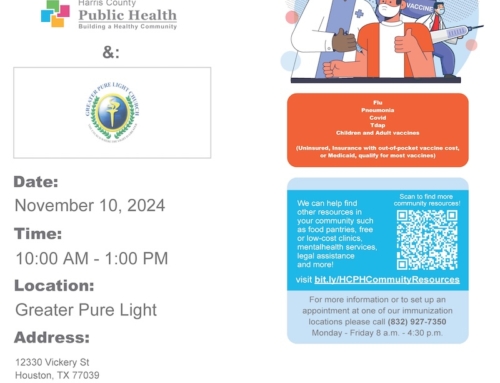

Date: April 21, 2015

Presentation: 9:30 AM to 12:30 PM

One-on-one Counseling Sessions: 12:30 PM to 2:30 PM

Location:

Lone Star College – Kingwood Campus

20000 Kingwood Drive

Performing Arts Center Building – Room #125

Kingwood, TX 77339-3801

Registration Cost: $24.95 (box lunch included)